Manage your cash flow with Wave

The app offers a receipt scanning feature as well, but you have to pay a subscription fee to access what is the liability to equity ratio of chester it. There’s a fee involved with accepting online invoice payments, too. Customers can pay via credit card, bank payment or Apple Pay. These features help keep our invoicing, and accounting, free.

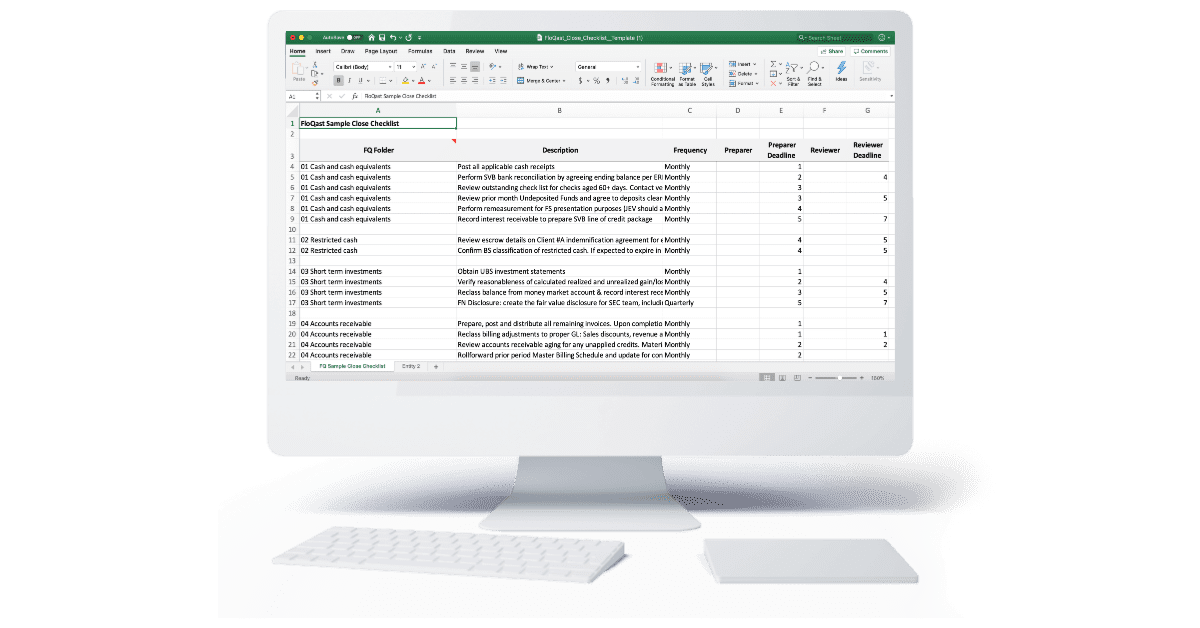

Say #sorrynotsorry to your spreadsheets and shoeboxes. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. Here is a list of our partners and here’s how we make money. Wave keeps up to date records so you’ll always have the info you need for filing – or sharing with your accountant. Charge for a one-time compliance audit or ongoing site maintenance; you can schedule recurring invoices or send them manually whenever you need to.

Unlimited bank and credit card connections

If you do want live support, you’ll need to invest in an Advisor or paid service. Includes tools that help automate the reconciliation process and auto-categorizes transactions for you in the Pro plan, but you can’t set up your own bank rules; no global search function. Set up recurring invoices for your finance clients and safely store credit card info so you have one less thing to keep track of. See sent, viewed, paid and overdue invoices in one place so you know which clients are on the right track three main methods of calculating depreciation or need a nudge.

- Deposits are sent to the debit card linked to your account in up to 30 minutes.

- It lacks some of the useful features you may find in other accounting software, such as project management, time tracking and inventory management.

- This is particularly true if you don’t have much accounting experience and would like an easy-to-use, fully functional tool.

- Payments are a pay-per-use feature; no monthly fees here!

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

- Wave’s software is simpler—designed for easy use for freelancers and small businesses—while QuickBooks’ platform is designed to cover complex business needs and grow as your business grows.

Ratings and Reviews

The import from contacts button does not work at all and the layout to get to customers invoice is great after learning where it is. Not being able to see or input the expenses unless I pay for the quick receipt plan in app is kind of a bummer. I’m glad the option is still available online and the system works great and the amount of different charts available is super helpful. Can manage multiple businesses for free under one account; lacks project tracking tools, industry-specific reports and transaction tracking tags. Wave Accounting is ideal for micro businesses with fewer than 10 employees, contractors, freelancers and other service-based businesses on a budget.

Keep track of your business health

Payments are a pay-per-use feature; no monthly fees here! Your deposit times may vary based on your financial institution. All payments are subject to a risk review and periodic credit risk assessments are done on business owners because we need to cover our butts (and yours). In some cases, we may hold funds and request more information if we need it for the protection of your business and Wave’s. With Wave, you’ll be able to send unlimited, customized invoices to your customers, manage an unlimited number of expenses and track unlimited receipts through its receipt scanning and capture feature.

Best Accounting and Bookkeeping Apps for Small Businesses

Read our Wave vs. QuickBooks review to learn more. Wave Accounting offers free software, meaning you won’t need to submit a credit card or payment information to use it. It can help you manage your bookkeeping, accounting and invoicing processes through a few internal integrations. NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business.

Approval to use online payments is subject to eligibility criteria, including identity verification and credit review. You’ll need to answer a few questions about your business and provide us accounting procedures for product rebates with a little more information about yourself in order to get approved to accept online payments. You can enjoy features such as unlimited income and expenses tracking, digital receipt upload and transaction management and access its invoice mobile app at no cost. Make it easier for your customers to pay you through a Wave invoice, right from their bank accounts. Wave’s online payments feature lets you accept bank payments, quickly and easily. Approval is subject to eligibility criteria, including identity verification and credit review.

For example, QuickBooks Online doesn’t have a free plan, but offers four paid plans, each with additional features, making it a great choice for scalability. With the higher-tier QuickBooks plans, you have access to inventory management, billable expenses and project profitability tools, none of which are offered with Wave. Show clients they’re in good hands by sending business invoices, estimates, and receipts. Automate overdue reminders and credit card payments to reduce friction and focus on the work. Wave’s software is simpler—designed for easy use for freelancers and small businesses—while QuickBooks’ platform is designed to cover complex business needs and grow as your business grows. If you’re a freelancer or other solo service provider, Wave is a better option.